-

山東如意科技集團紡織廠加濕案例—高壓微霧加濕系統了解詳情

山東如意科技集團紡織廠加濕案例—高壓微霧加濕系統了解詳情 - 山東如意科技集團是國家級高新技術企業,紡織產業突出貢獻企業,中國毛紡織最具競爭力十強企業。是全球知名的創新型技術紡織企業,被中國紡織工業協會列為毛紡行業國家級新產品開發基地。

-

電子廠加濕除靜電案例—靖邦科技SMT車間了解詳情

電子廠加濕除靜電案例—靖邦科技SMT車間了解詳情 - 我公司自主研發生產的電子廠加濕除靜電系統,能多方面解決電子廠問題,并能起到節能降耗,提高效率和穩定性等作用。

-

印刷廠加濕/包裝廠加濕工程案例了解詳情

印刷廠加濕/包裝廠加濕工程案例了解詳情 - 在生產過程中濕度對包裝廠、印刷廠的影響:紙張是由植物纖維組成,植物纖維具有多孔性和親水性,對水十分敏感。環境溫濕度稍有變化,紙張含水量會有變化。空氣相對濕度對紙張含水量的影響,一般是相對濕度增加,紙張含水量增多,反之,相對濕度降低,紙張含水量減少。而紙張含水量的大小,與印刷性能有直接關系。例如,紙張含水量變化會引起紙張伸縮(包括局部變形)。

-

加濕器在汽車噴漆車間的運用了解詳情

加濕器在汽車噴漆車間的運用了解詳情 - 涂裝車間加濕系統 噴涂車間加濕器 汽車噴漆車間加濕器新聞資訊:汽車在生產過程中,會經過沖壓、焊接、涂裝、裝配四大工藝,而涂裝作為其中的一個環節,相比于其它三大工藝更為特殊,不僅因為它的材料、工藝過程,同樣因為涂裝對于環境的要求更為嚴格,因為涂裝環境的好壞直接影響著產品質量,在一個沒有受控的環境內進行涂裝作業,纖維、顆粒、縮孔等漆膜弊病極易出現。

-

浙江某水泥攪拌廠噴霧除塵案例了解詳情

浙江某水泥攪拌廠噴霧除塵案例了解詳情 - 水泥攪拌廠在生產作業過程中,會產生大量漂移粉塵和飛灑粉塵,另外在冬季與春季天氣干燥,風力較大,使得粉塵隨風四處飄散,飄移粉塵顆粒一般在5-50微米,在風力的驅動下可以飄移幾十公里,對附近的環境、人身、及周邊居民的危害非常大。

-

景區噴霧降溫案例了解詳情

景區噴霧降溫案例了解詳情 - 為解決景區噴霧降溫問題,我公司特別制定了以高壓微霧加濕系統為主的一套降溫方案,該套方案主要是利用高壓微霧加濕器通過高壓管道,配合噴頭,將水霧化,解決景區噴霧降溫問題。

-

超聲波加濕器在食品廠車間的作用了解詳情

超聲波加濕器在食品廠車間的作用了解詳情 - 食品安全問題一直受到消費者的關注,與此同時受到關注的還有口感、營養、包裝等等,不管是哪一種,出現問題都會影響到產品的銷售。食品生產對空氣濕度要求很嚴格,因為食品容易被微生物腐蝕。

-

煙草行業加濕工程案例了解詳情

煙草行業加濕工程案例了解詳情 - 煙草行業使用的加濕器通常是加濕速度快、水霧的顆粒小、霧化能效高且使用能耗低的節能加濕器。而煙草行業加濕器主要是超聲波加濕器,超聲波加濕器具有加濕效果明顯、顆粒小且速度快等優點,能夠明顯改善煙葉生產以及煙草加工的環境濕度,保證煙葉的品質以及使用率。除此之外,超聲波加濕器對于人體健康以及環境的舒適性也是有一定幫助的,且超聲波加濕器擁有無水自動保護的功能,能夠保證水霧顆粒的質量,為煙草行業創造更好的生產環境。

-

空調配套加濕案例了解詳情

空調配套加濕案例了解詳情 - 工業生產車間中空氣調節設計規范對舒適性空調以及各個行業生產工藝空調的濕度控制都有明確的要求,濕度滿足不了要求,將會帶來很多不良后果。

-

人工造霧案例—房地產中央花園霧化了解詳情

人工造霧案例—房地產中央花園霧化了解詳情 - 人工造霧是指通過機器設備,人為的創造出霧化效果,以達到真實起霧一樣的效果,并且人工造霧霧化效果可調,更加實用。

-

生產場所、公共場所噴霧消毒工程案例了解詳情

生產場所、公共場所噴霧消毒工程案例了解詳情 - 杭州力創實業有限自主設計研發,推出一款專門用于生產場所、公共場所噴霧消毒的系統,能及時有效的解決企業生產過程中大規模、定點、定時化消毒的問題。

加油站降溫案例

加油站降溫案例 公交站降溫案例

公交站降溫案例 超市保鮮加濕工程案例

超市保鮮加濕工程案例

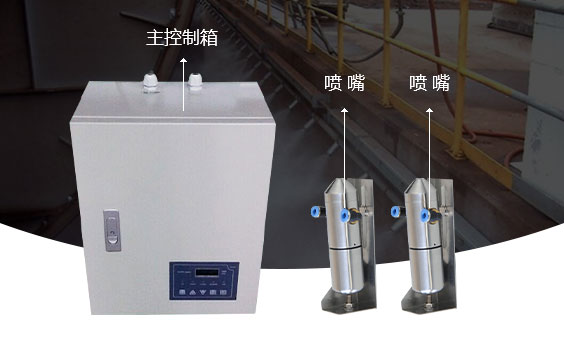

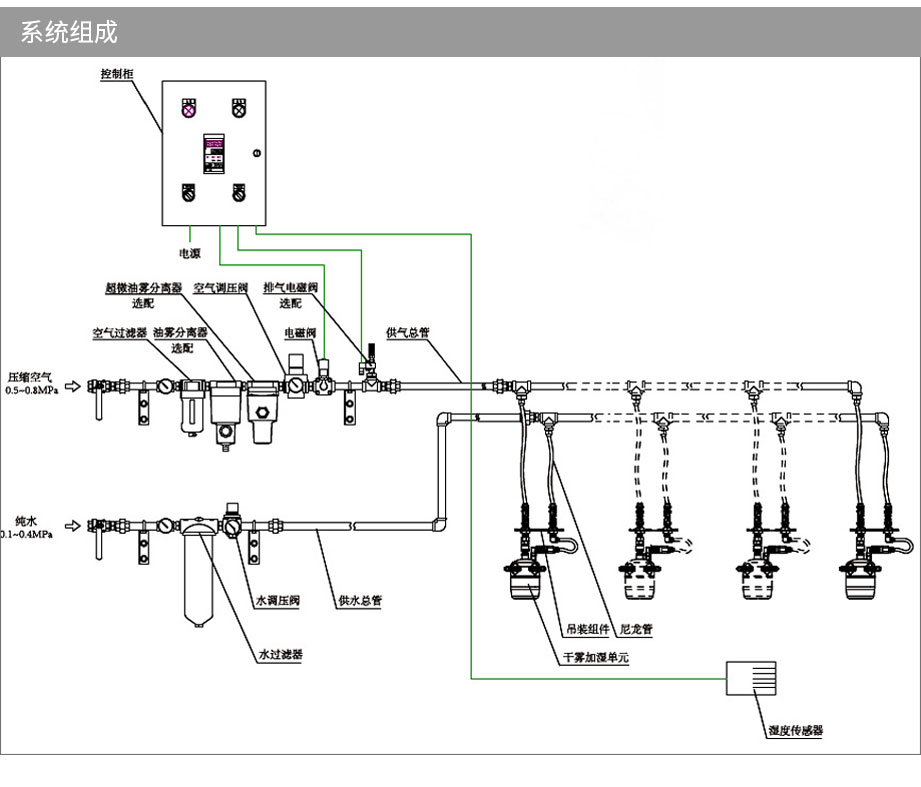

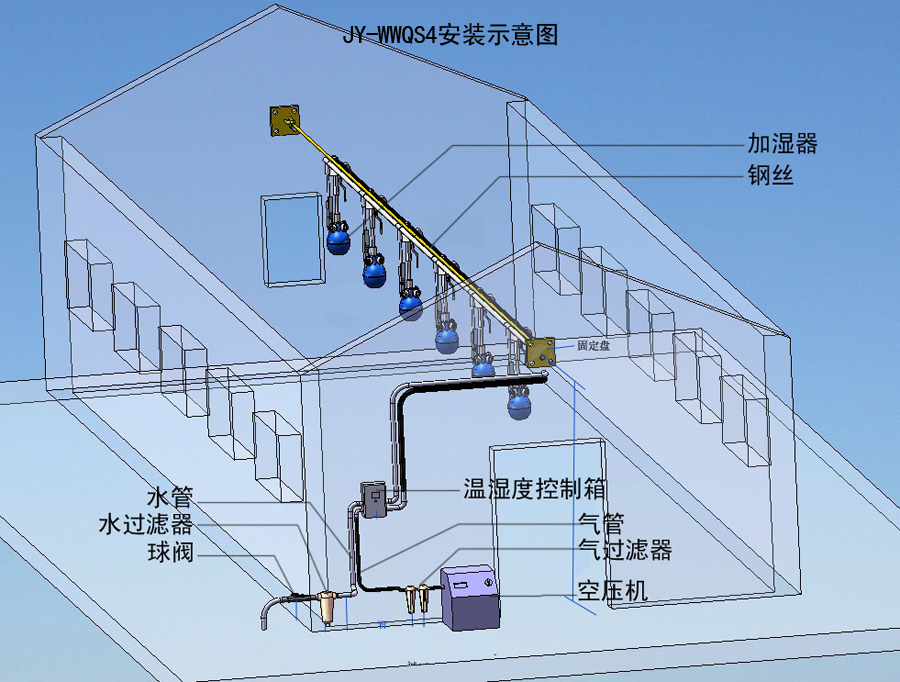

CY-GY-E升級款高壓微霧加濕系統

CY-GY-E升級款高壓微霧加濕系統 CY-GY-B升級款高壓微霧加濕系統

CY-GY-B升級款高壓微霧加濕系統 CY-ST離心式手推加濕器

CY-ST離心式手推加濕器

18969925222

18969925222

· 中德技術結合

· 中德技術結合 · 優秀設計方案

· 優秀設計方案 · 高效服務團隊

· 高效服務團隊 經久耐用

經久耐用 智能控制

智能控制 節能環保

節能環保 人性售后

人性售后 歐盟CE證書

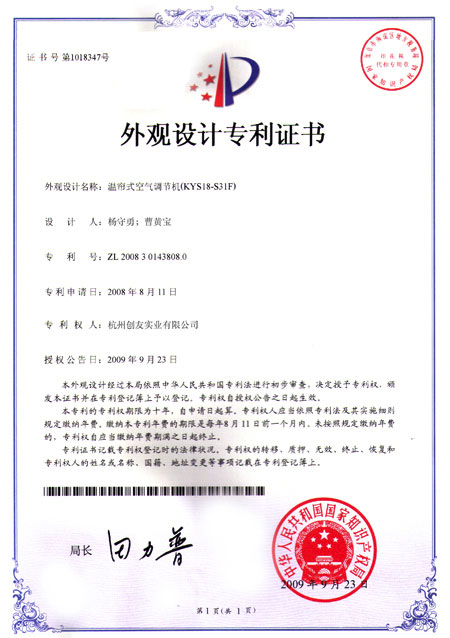

歐盟CE證書 外觀設計專利

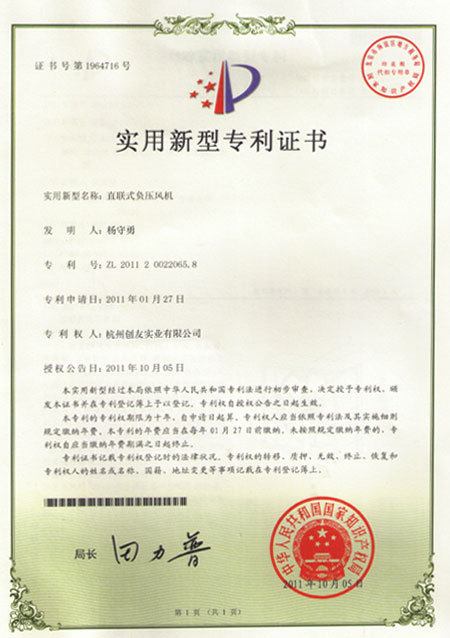

外觀設計專利 直連負壓風機專利

直連負壓風機專利 質量管理體系證書(英文)

質量管理體系證書(英文) 質量體系認證證書(中文)

質量體系認證證書(中文) 離心式環保空調專利

離心式環保空調專利 離心加濕器專利證書

離心加濕器專利證書 環保空調外殼專利

環保空調外殼專利 電路總成專利

電路總成專利 ISO9001

ISO9001 3A信用證書

3A信用證書